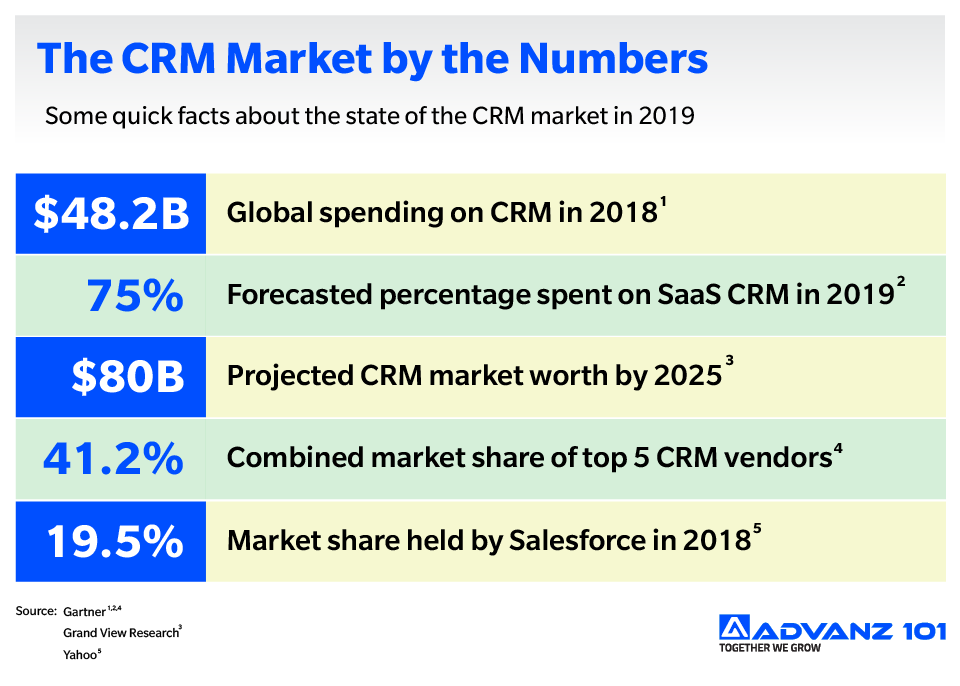

Modern CRM or CRM for the past few years is being delivered in the ambit of Software-as-a-Service (SaaS) and is expanding rapidly into the burgeoning consuming yet developing markets along with the rest of the world. To quote some promising numbers according to Technavio, leading market research company with global coverage, the global SaaS Customer Relationship Management is set to grow by USD 33.15 billion during 2019-2023.

Also, marketing in the Relationship Era which refers to the current period of businesses’ gradual shift across the global market to long-lasting relationships with prospects and customers, has set the ball rolling for processes that lead to building profitable and lasting relationships with targeted customer groups. CRM essentially works on two systems, viz., operational and analytical and both these frameworks witnessed a massive fillip with the following market trends for 2019 and shall continue to.

Salesforce has been way ahead of the curve. They identified these trends early on and have predominantly used acquisition as an aggressive strategy to stay ahead of the competition. These acquisitions illustrate how Salesforce has always been on point when it comes to filling a gap with best-in-class vendors on the market. They have successfully rebranded and weaved each of them technically into the Salesforce Platform.

1. Increased usage of Social CRM

Social CRM has grown to become the perfect medium in the digital environment to gather data across multiple social networks because of their ability to transparently display customer sentiment towards a brand or company. It comprehensively monitors social networks for creating an overview of market sentiment with positive, negative or neutral public reactions/comments. Additionally, Social CRM aid in monitoring required keywords that aggregate all the posts containing them for sales and marketing teams to ascertain and attend to market feedback.

The scope of social media in context with CRM platforms is only going to broaden as businesses are increasingly taking to these social networks to respond to customers’ feedback and queries effectively and quickly. In case of negative responses, companies can go in damage control mode without further delay and mitigate escalation. The same responses/feedback can be used to customize products and services in tune with customer expectations.

With these roles to play, the Social CRM market globally is estimated to grow by US $204.3 billion by 2025, guided by a compounded growth of 52.8% as per Global Industry Analysts, Inc. Salesforce was early to spot this shift and made the right moves.

ACQUISITIONS:

Buddy Media – June 2012 – $649 Million

Buddy Media a social media marketing platform that helped companies build strong connections and maintain relationships with customers was bought by Salesforce to offer social media management features to their customers and an additional medium for Salesforce customers to pump data into their CRMs. It could also be used across multiple business functions, enhancing its appeal.

Buddy Media was put together with Radian6 to form Social Studio (part of marketing cloud) and this Studio functions at the level of large enterprises that need to manage their social channel content and measure engagement.

2. AI is changing CRM

Artificial Intelligence helps CRM with usability and currently every major CRM is equipped with tangible results yielding AI capabilities. Most CRM giants, majorly Salesforce has been investing massively in AI to maintain its market position. CRM platforms are on the path to convince the corporate world that AI is the future of CRM. CRM-AI integration has led to a conversational workflow on the platform along with face and text recognition combined with voice functionalities, making the complex CRM ecosystem easier to use and navigate.

Voice commands part of AI-powered CRM help companies analyse information from simple as well as complicated data sets; they further simplify tasks and allow dictation instead of typing for command access. As AI gradually automates CRM, the inefficient aspects of platforms get phased out, workflows are optimised ensuring reduced costs and overall improved marketing strategies. Predictive analytics and language processing steered by deep learning and machine learning shall lead CRM’s shape shifting for the remainder of 2019 and onward by AI.

By absorbing customer relationship patterns AI will help businesses in upping their CRM functionality and will continue on that path as it is consistently fed customer knowledge.

ACQUISITIONS:

Krux – October 2016 – $800 Million

Krux aided marketers, publishers, and agencies churn revenue by delivering smarter content, commerce, and overall marketing experiences. Salesforce swept it up to fill the missing space of programmatic digital advertising on its platform.

Upon acquisition Krux was swiftly rebranded as Salesforce Data Management Platform (DMP) and integrated with the Marketing Cloud. In 2017 it was crowned the DMP market leader for its unique offering i.e. rather than algorithmically deriving insights from aggregated data, it takes in raw data and applies machine learning for surfacing of insights and eliminated the inherent biases that algorithms contained.

3. Indispensable Mobility

CRM developers and specialists are often faced with a roadblock when devising ways to improve sales approach on different kinds of devices like smartphones, tablets, etc and any other device that might emerge in the near future. This is where mobility comes into play and will be an experience defining trend for the near future and beyond. Given the state of hypercompetition in the market, businesses with foresight are preparing to use mobile devices and voice technology as part of their CRM strategy and are paving their marketing paths with optimized integrations.

This also indicates the growing importance of language processing technologies for companies to plug-in specific functionalities into their CRM like record updates, voice activated interactions, etc. Therefore, mobility is and will be all about maintaining consistent CRM control across all channels and managing communication flow with the help of technology’s most advanced mediums.

ACQUISITIONS:

ClickSoftware – August 2019 – $1.35 Billion

ClickSoftware a privately held field service company has agreed to be acquired by Salesforce, who wants to combine its existing tools for dealing with field service, Field Service Lightning built on Service Cloud involving employee tracking for the ones headed out to perform maintenance for customers with the capabilities of ClickSoftware to chart the future of field service offerings.

The deal is expected to close in the fall of 2019 and is targeted towards accelerating the growth of Service Cloud and propel innovation with Field Service Lightning to better meet its customers’ needs.

Quip – August 2016 – $750 Million

Quip is a dynamic document platform that merges documents, spreadsheets, and communication to help team members or teams get work done faster and better without any communication snags. Salesforce was always trying to give users the features to store documents on Salesforce and not only make them shareable but also contextual to whichever CRM they belonged to and this furthered confusion.

Eventually Quip was acquired by Salesforce because of its collaboration abilities increasing user satisfaction and dramatically helping platform adoption. Quip, the name was retained post acquisition and it gained quite the following because of its ‘living/dynamic documents’ that bi-directonally sync CRM data with documents, spreadsheets, and Live Apps for swift collaboration across calendars, images, videos, etc.

4. Immersive Customization

Businesses of any scale adopt CRM to address specific entreprise problems and needs and to modernise their existing applications which readies the base for complete business transformation. Due to this prevalent trend of buying CRM to diagnose a singular problem instead of implementing the full suite, CRM vendors are now increasingly fragmenting their front-office applications to allow customers, Independent Software Vendors (ISV), and system integrators the space to leverage smaller pieces of functionality – leading to deep customization.

The golden rule of retaining customers is to make them feel valued. Companies are diving into years of customer data to personalize experiences for them and to gauge customer needs well before the customer itself, to stay ahead of the competition. CX or Customer Experience is the key differentiator in the SaaS market today and deep personalization/hyper individualization is the path to go about it. Understand your customers, identify and segregate their preferences and needs, and then put together a unique yet lucid experience with the aid of Artificial Intelligence to acknowledge them.

ACQUISITIONS:

ExactTarget – June 2013 – $2.5 Billion

Salesforce was seeking something like ExactTarget for their enterprise Marketing Suite because it provided on-demand and one-to-one email marketing software applications. ExactTarget was the foundation for Salesforce’s expansion in the pre-sales direction. Marketing Cloud was certainly boosted with the addition of ExactTarget’s marketing automation capabilities especially in terms of email marketing.

Marketing Cloud now split into 7 products is at the peak of operational efficiency and multichannel functionality. Marketers can now cover email, SMS, social, online advertising and much more with the product suite. The user experience is far more engaging now. Exactly 6 months before Salesforce acquired ExactTarget, the latter acquired Pardot to position itself better to both B2B and B2C prospects.

Demandware – June 2016 – $2.8 Billion

Salesforce had mastered B2B cloud software market but was ambitious to carve its space in front-end operations and this is where e-commerce fit in, as their missing piece of the puzzle for customer engagement. Demandware provides enterprise cloud commerce solutions that drive/help the globe’s leading retailers to constantly innovate.

Upon acquisition Demandware became Commerce Cloud quickly and caught the attention of next-gen retailers who wanted to put an end to scattered and incomprehensible data sources. Commerce Cloud brought about an ‘Omnichannel Commerce’ approach that catered to e-commerce holistically with a ‘single source of truth’ for all processes.

5. Data Mining tech will be the next big leap

All the above factors and others will come together to create a CRM experience with ample fresh data. Even the most comprehensive and successful CRM strategies leave behind a heavy trail of data which if not put to use leaves the roadmap for future unclear. Therefore, CRMs will utilize advancements in AI to draw maximum benefits out of the surplus data.

AI is currently utilized in the space of CRM ecosystem to automate already existing tasks. With due technological advancement the current lot of CRM applications will prove to be archaic when put against what AI will achieve in the future. The data on the table needs to be utilised meaningfully but that can only be executed to fruition with the help of AI.

Marketers and entrepreneurs from all sectors are looking at ways to get their hands on as much data as possible. Informed and data-driven decisions are the order of the day and a primary objective for startups and medium to large enterprises alike. According to a report published by Reuters, the global business intelligence market is expected to touch $30 billion by 2022. The reason for this market expansion is business intelligence that will focus more on ‘what will happen’, in other words Predictive and Prescriptive Analytics.

Armed with these analytics and insights, businesses can filter opportunities faster, improve estimation and forecasting, and make sound and data-driven decisions. A major shift towards using self-service platforms is also anticipated because they provide significant competitive advantage without having to recruit data science professionals.

ACQUISITIONS:

Mulesoft – March 2018 – $6.5 Billion

Mulesoft provided Salesforce a software platform enabling easy building of application networks using APIs. It was the glue that would allow applications to talk to each other and exchange data.

It was shared that Mulesoft will transform into ‘Integration Cloud’ where customers will easily be able to map and manage systems for a complete view of data, devices, and apps. The market awaits to see if Integration Cloud will remain focused on enterprise-level or have a price point for the SMB market as well.

Tableau – June 2019 – $15.7 Billion

Tableau, the #1 analytics platform combined with the world’s #1 CRM became the strongest solution to accelerate customers’ digital transformation. This acquisition also became a stepping stone for Salesforce to supercharge its presence in the $1.8 trillion digital transformation space. Salesforce users are now set to unlock far greater value from their data and make smarter business decisions driving intelligent customer experiences.

Salesforce will be pivoting Tableau to further its aim of helping the world at large see and understand data. Afterall, data is the foundation of every digital transformation and Salesforce is resolute about delivering powerful analytics to every user. The acquisition is being seen as a path to make Salesforce Customer 360 including Salesforce’s analytics capabilities a lot more stronger to enable Salesforce’s customers drive innovation and make informed decisions for every dimension of their business.

Onward and Upward

One of the significant changes these acquisitions have had over the market is that the modern analytics and BI market has been changed forever and become more mainstream with large enterprises deploying platforms like Tableau across every team/department. This is a major positive reflecting that large businesses in terms of data and analytics require a hybrid on-premise/cloud approach in addition to multi cloud support.

The above cited diverse acquisitions and many others by Salesforce have had major implications for different segments of the enterprise software landscape like cloud, SaaS, iPaaS, and integration.

Researchers with a telescope on the market are anticipating an acquisition by AWS of its own BI and analytics solution or development of its own variant of an in-house BI and analytics product in light of the big sweeps by Salesforce. Eyes are also on AWS because Tableau has the most popular pairing with the AWS platform.

Next-gen CRM is around the corner with intelligent and integrated CRM solutions as mainstays and the market front runners beginning from Salesforce to MS Dynamics 365, ZOHO, Suite CRM, SugarCRM, etc have to embrace the fact that customer satisfaction has replaced customer experience as the topmost sales metric and is here to stay. Market favourites, startups, aspiring players, and enterprise software stakeholder of every hue needs to keep up with far greater precision and predictive analytics along with a focus on customer needs and behaviour to realise customer-centric goals which are basically the backbone of the CRM ecosystem.

Salesforce is building new horizons for CRM and thus expanding what a CRM can or cannot do. Most growth has been by way of acquisitions but 7th November’s announcement of getting into content management by building an in-house system, called Salesforce Content Management System (instead of acquiring one) shows that SF is striking a balance while pacing ahead.

Amidst these market waves, future dynamics of CRM will witness a redefining of great customer experience, determined by how much a customer was treated as a person instead of an opportunity. Thus, when buyers have definitely changed, why shouldn’t your CRM?